How to identify best Investment Advisory Services India?

As a business on a path to grow continually, one of the important factors is exploring the best investment advisory services in India. Investment is crucial for a business to grow bigger and better. But instead of guiding you, the innumerable options might end up confusing you even further. That highlights the need to sift through the options and identify the top options in investment advisory services in India. Let’s learn a little more about it:

What are Investment Advisory Services India?

Investment advisory services India refer to professional guidance provided to individuals or entities seeking assistance in managing their investments. These services encompass a range of activities, including financial analysis, portfolio management, risk assessment, and investment strategy development.

Investment advisory firms in India typically offer personalized recommendations tailored to the specific financial goals, risk tolerance, and investment preferences of their clients. They may advise on various asset classes such as stocks, bonds, mutual funds, real estate, and alternative investments.

Key Aspects of Stock Investment Advisory Services India

Key functions of investment advisory services in India include:

Financial Planning:

Assessing clients’ current financial situations, identifying goals, and developing comprehensive plans to achieve those objectives through strategic investment decisions.

Portfolio Management:

Constructing and managing investment portfolios based on clients’ risk profiles and investment objectives, with a focus on diversification and risk mitigation.

Market Research and Analysis:

Conducting thorough research and analysis of financial markets, economic trends, and specific investment opportunities to make informed investment recommendations.

Risk Management:

Evaluating and managing risks associated with investment decisions, including market risk, credit risk, liquidity risk, and regulatory risk.

Performance Monitoring and Reporting:

Tracking the performance of client portfolios, providing regular performance reports, and making necessary adjustments to investment strategies as market conditions and client goals change.

Regulatory Compliance:

Ensuring compliance with relevant regulatory requirements and standards governing the provision of investment advisory services India.

Perks of Investment Advisory Services India

Following are the perks of investment advisory services India, along with how they compare to business management consultant and financial advisory services:

Expert Financial Guidance:

Investment advisory services in India provide expert financial guidance tailored to individual client needs, helping them navigate complex investment landscapes effectively. Business consultants may offer financial advice, but their focus extends beyond investments to overall business strategy.

Personalized Investment Strategies:

Investment advisors create personalized investment strategies based on clients’ financial goals, risk tolerance, and market conditions. This personalized approach ensures that clients receive tailored recommendations aligned with their specific objectives. Business consultants may offer strategic advice but may not specialize in personalized investment strategies.

Portfolio Diversification and Risk Management:

Investment advisors focus on portfolio diversification and risk management, ensuring that clients’ investments are spread across different asset classes to minimize risk. They constantly monitor market trends and adjust portfolios accordingly. While business management consultant may address risk management within a broader operational context, they may not specialize in investment portfolio management.

Regulatory Compliance Assurance:

Investment advisory services India ensure compliance with relevant regulations governing the provision of financial advice, providing clients with peace of mind regarding legal and regulatory requirements. Business consultants may offer guidance on regulatory compliance but may not specialize in the intricacies of financial regulations.

Performance Monitoring and Reporting:

Investment advisors regularly monitor portfolio performance and provide detailed performance reports to clients, enabling them to track progress towards their financial goals and make informed decisions. While business management consultants may offer performance monitoring as part of their services, their focus may be more on overall business performance rather than specifically on investment performance.

Access to Investment Opportunities:

Investment advisory services provide clients with access to a wide range of investment opportunities, including stocks, bonds, mutual funds, real estate, and alternative investments. Advisors conduct thorough research and analysis to identify suitable investment options aligned with clients’ objectives. Business consultant may not specialize in sourcing and evaluating investment opportunities.

In summary, investment advisory services India offer specialized expertise in investment management, personalized strategies, regulatory compliance assurance, and performance monitoring, distinguishing them from the broader strategic advisory services provided by business management consultants and financial advisory services.

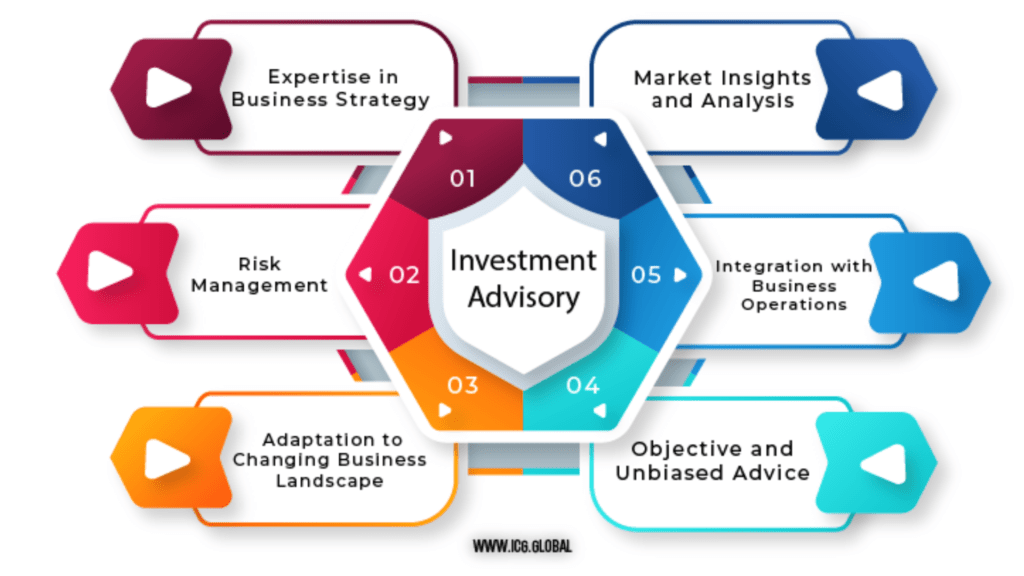

Why do your need Business Consultants for Investment Advisory Services India?

Business consultants can play a crucial role in investment advisory services India for several reasons:

Expertise in Business Strategy:

Business consultants are skilled in strategic planning and can help businesses align their investment strategies with broader business objectives. They can assess how investment decisions impact overall business performance and guide clients in making strategic choices that maximize returns and contribute to long-term growth.

Market Insights and Analysis:

Business consultants often have extensive experience and knowledge of local and global markets. They can provide valuable insights and analysis to inform investment decisions, helping clients identify emerging trends, assess market risks, and capitalize on investment opportunities in India and beyond.

Risk Management:

Investment advisory services inherently involve risk, and business consultants are adept at assessing and mitigating risks across various dimensions. They can help clients develop robust risk management frameworks, diversify investment portfolios, and navigate regulatory complexities to minimize exposure to potential losses.

Integration with Business Operations:

Business consultants can ensure that investment strategies are integrated seamlessly with business operations. They can help clients optimize operational efficiency, streamline processes, and allocate resources effectively to support investment initiatives and maximize returns.

Adaptation to Changing Business Landscape:

The business landscape is constantly evolving, and investment strategies must adapt accordingly. Business consultants can provide ongoing guidance and support to help clients navigate changes in market conditions, regulatory environments, and competitive landscapes, ensuring that investment decisions remain aligned with business objectives.

Objective and Unbiased Advice:

Business consultants provide an external perspective that can be invaluable in decision-making processes. They offer objective and unbiased advice based on rigorous analysis and industry expertise, helping clients make informed investment decisions that are free from internal biases or conflicts of interest.

Overall, leveraging the expertise of business consultants can enhance the effectiveness of investment advisory services India by providing strategic guidance, market insights, risk management expertise, operational integration, and objective advice personalized according to the specific needs and objectives of clients.

How Business Management Consultant help with Investment Advisory Services India?

Business management consultant in India provides advisory services related to investment, albeit from a broader perspective. While investment advisory services primarily focus on managing financial assets, business consultants offer strategic guidance on various aspects of business operations, including but not limited to:

Strategic Planning:

Assisting businesses in defining their vision, mission, and strategic objectives, and developing actionable plans to achieve sustainable growth and competitive advantage.

Operational Efficiency:

Identifying inefficiencies and areas for improvement within organizations, optimizing processes, and implementing best practices to enhance productivity and profitability.

Market Entry and Expansion:

Advising businesses on market entry strategies, expansion opportunities, and international expansion initiatives, including market research, feasibility studies, and risk assessment.

Organizational Development:

Providing guidance on organizational structure, talent management, leadership development, and change management initiatives to foster a culture of innovation and continuous improvement.

Financial Management:

Offering financial advisory services such as budgeting, financial forecasting, cash flow management, and capital structure optimization to support sound financial decision-making.

In summary, while investment advisory services India focus specifically on managing investments and financial assets, business consultants offer a broader range of strategic and operational advisory services to help businesses achieve their overall objectives and enhance organizational performance.

Best Investment Advisory Services in India

Reasons why a business management consultant like ICG might be considered among the best:

Expertise Across Multiple Domains:

ICG’s proficiency in business management consulting, financial and investment advisory services allows them to offer solutions to clients. Their multidisciplinary approach enables them to address a wide range of business challenges effectively.

Proven Track Record:

ICG has a record of delivering results and value to clients, it enhances their reputation as a top-tier business consultant. Positive testimonials, case studies, and client referrals can attest to their capabilities and success in driving business growth and improvement.

Customized Solutions:

The ability of ICG to tailor their services to meet the unique needs and objectives of each client is crucial. By understanding the specific challenges facing their clients, they can develop customized strategies and solutions that yield optimal results.

Global Perspective:

Given their focus on international business consulting, ICG likely brings a global perspective to their engagements. This can be invaluable for businesses in today’s interconnected and dynamic global marketplace, helping them navigate cross-border challenges and opportunities.

Thought Leadership and Innovation:

ICG can differentiate by demonstrating thought leadership and innovation in its approach to business management consulting, investment and financial advisory services in India. This will help ICG establish itself as a leading provider of these services in the Indian market. Staying abreast of industry trends, emerging technologies, and best practices allows them to offer cutting-edge solutions that drive business success.

Client-Centric Approach:

A client-centric approach, where ICG prioritizes the needs and objectives of their clients, fosters long-term relationships and client loyalty. By maintaining open communication, providing proactive support, and delivering value consistently, they can establish themselves as trusted advisors to clients.

Want to stay updated on our latest initiatives? Follow us on LinkedIn for industry insights: https://www.linkedin.com/company/irish-consulting-group/.

Conclusion

Identifying the best investment advisory services in India requires careful consideration of various factors, including expertise, track record, personalized services, regulatory compliance, and performance monitoring capabilities. Business management consultants, specializing in investment and financial advisory services in India, can play a crucial role in this process. They offer strategic guidance, market insights, risk management expertise, operational integration, and objective advice to the specific objectives of clients. Leveraging the expertise of business consultants enhances the effectiveness of investment advisory services by providing solutions that help business growth. Top-tier business management consultants like the Irish Consulting Group demonstrate proficiency in investment advisory, financial advisory, and broader business consulting. Their multidisciplinary approach and client-centric focus make them ideal for businesses seeking comprehensive advisory support in India.

Contact us: https://icg.global/contact-us/