Legal Requirements To Start A Business In India

India’s legal requirements are vital to many entrepreneurs who wish to start their business in the country. However, this can be very confusing, especially if you are new. Thus, it is important to understand the specific legal requirements that would make your entrepreneurial journey in India smooth and compliant. This guide will provide you with an outline of the legal steps you require when starting a business.

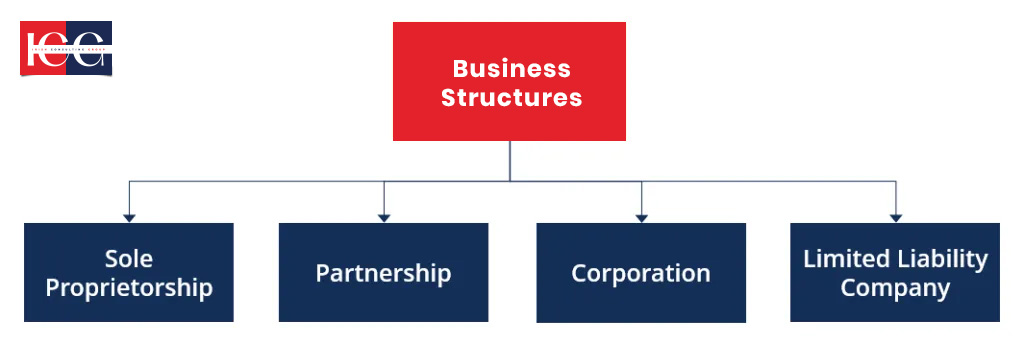

Choosing The Right Business Structure

The first thing to decide upon before setting up your business is how it should be structured. Selecting the appropriate business structure is a focal decision when start a business in India. The chosen structure will influence factors such as tax liability, ownership rights, and legal responsibilities.

Sole Proprietorship:

This is the simplest form of business ownership, where a single individual is responsible for all aspects of the enterprise. It’s suitable for small-scale businesses with minimal capital requirements.

Partnership:

A partnership involves two or more individuals sharing ownership and responsibilities. They are mainly of two types: general partnerships and limited partnerships.

Limited Liability Partnership (LLP):

This hybrid structure combines elements of a partnership and a company, offering limited liability to its partners. It’s a popular choice for professional firms and startups.

Private Limited Company:

A private limited company is a separate legal entity with limited liability for its shareholders. It’s suitable for businesses that require a more formal structure and seek to raise capital from investors.

Public Limited Company:

A public limited company is a large-scale enterprise that can offer shares to the public. It’s suitable for businesses that need to raise substantial amounts of capital by listing in the stock market.

The choice of organizational structure depends on several factors, including enterprise nature, capital investment needs, and risk levels.

Obtaining Essential Licenses And Permits

Depending on the type of business you are in, there may be several licenses and permits that you need. The following are some common ones:

General licenses and permits

Shop and Establishment License:

This is a mandatory license for businesses operating from physical premises. It ensures compliance with local regulations and provides identification for the business.

Goods and Services Tax (GST) Registration:

GST is a multi-stage tax levied on the supply of goods and services. Businesses with an annual turnover exceeding a certain threshold are required to register for GST.

Trade License:

Some municipalities or local authorities may require a trade license to operate a business within their jurisdiction.

Fire Safety Certificate:

Businesses in certain industries, such as manufacturing or warehousing, may need to obtain a fire safety certificate to ensure compliance with fire safety regulations.

Industry-specific licenses and permits

Food Safety and Standards Authority of India (FSSAI) License:

Businesses dealing with food and beverages, including restaurants, food processing units, and grocery stores, must obtain an FSSAI license to ensure food safety and quality.

Drug License:

Pharmaceutical companies and drug stores require a drug license from the state drug controller.

PCB and other environmental clearance Certificate:

Businesses with significant environmental impact, such as manufacturing units or construction projects, may need to obtain Pollution Control Board (PCB) Certificate and other environmental clearance from the Ministry of Environment, Forestry, and Climate Change.

Import-Export License:

Businesses involved in international trade need to obtain an import-export license from the Directorate General of Foreign Trade (DGFT).

Other industry-specific licenses:

Depending on the nature of your business, you may need additional licenses or permits, such as a liquor license, a transport license, or a broadcasting license.

Compliance with labor laws

In India, employment relationships are governed by an extensive set of labor laws. There are several key components to focus on, including:

Minimum wages:

Employers must pay their workers at least the minimum wage specified by the government.

Working hours:

There are per-day limits and established weekly working hours, along with provisions for overtime payment.

Employee Social Security and other Benefits:

Employers must provide their employees with various benefits, such as ESI, Provident Fund, gratuity, etc.

Health and Safety:

Employers must ensure the health and safety of their employees at the work place.

Holidays and Leaves:

Employees are entitled to enjoy holidays and leaves as per statutory provisions to ensure work-life balance.

Industrial Disputes Resolution:

The Employer and employee must maintain harmonious industrial relations and comply with rules and regulations for resolving disputes between them.

Tax registration and compliance in India

To start a business in India, one has to undertake a few important stages, one being registration with tax authorities. A running enterprise needs to comply with several taxing rules in order to avoid penalties, fines, and financial losses. Below are some commonly known forms of tax that must be registered for, on time by businesses operating in India:

Income Tax

This is a compulsory levy imposed on any income received by individuals, corporations, or other organizations. In India these matters are governed by the Income Tax Act of 1961, which deals with the calculation, assessment, and collection of taxes.

Goods and Services Tax (GST)

Goods and Services Tax, or GST, is an inclusive tax imposed on the distribution of goods and services in India at different stages. It is a kind of indirect tax that has taken over several other taxes such as, VAT, service tax, and excise duty.

What are the registration requirements?

Every firm that sells commodities or renders services must register for the GST if its annual revenue surpasses a determinate level (currently INR 20 lakh for services and INR 40 lakh for goods, although these figures may vary between states). On the contrary, small businesses with low turnover may wish to voluntarily register in order to benefit from input tax credit and comply with legal provisions.

Professional Tax

Professional tax is a state-level tax levied on individuals earning income from employment, professions, trades, or callings. This tax is imposed by state governments, and the rates may vary from one state to another.

Municipal Taxes

Municipal taxes, also known as local body taxes, are levied by local municipal authorities on properties within their jurisdiction. These taxes are generally based on the property’s annual value, location, type, and usage.

Intellectual property protection

Trademark registration plays a critical role in the protection of the unique identity of a business in the form of trade marks, patents, or copyrights. Intangible assets include brand names and logos, inventions or artistic works, and proprietary processes, among others. This is what makes them different from other products or services on the market. If these properties are not well thought out and preserved, they can be abused, which may lead to loss of finances, a stain on reputation, and a decline in market share.

Conclusion

To start a business in India can be quite challenging, but it can be less taxing with a clear understanding of the main legal requirements. Each step is important for an organization to be legally established and operate. Also, protecting your intellectual property helps to ensure that you maintain your brand’s identity as well as its distinct assets. Entrepreneurs who know what is expected of them under the law will create a strong base upon which their careers will thrive through time in India’s ever-changing commercial landscape.

With the legal requirements explained in this guide, you’re going to lay a good foundation for the success of your business. You may also consider getting advice from ICG’s attorneys and tax consultants to ensure that you comply with all the relevant laws concerning this field of operation.

Contact us: https://icg.global/contact-us/

Follow us on LinkedIn for industry insights and company news : https://www.linkedin.com/company/irish-consulting-group/.