Understanding Tax Management in India

Tax management in India plays a crucial role in the financial planning of individuals and businesses alike. With a complex tax structure comprising various direct and indirect taxes, understanding and effectively managing taxes have become imperative. In the following piece, let’s delve into the intricacies of tax management, exploring strategies, challenges, and future trends.

What is Tax Management?

Tax management is a strategic approach to handling taxes that involves minimizing liabilities while ensuring compliance with legal obligations. It encompasses activities such as tax planning, filing returns, and responding to tax notices.

Key elements of tax management include:

Proactive tax planning to minimize tax burdens and accurate filing to meet legal

- Optimization strategies to maximize after-tax

- Compliance management to adhere to tax

- Tax risk management to identify and mitigate potential

Overall, tax management aims to achieve financial goals in a legally compliant and financially prudent manner.

Importance of Tax Management in India

In India, taxes pose significant costs for individuals and businesses. Efficient tax management, or tax management in India, aims to lower tax burdens through strategic planning and compliance. It fosters financial stability and growth by optimizing planning strategies, ensuring legal compliance, and managing risks. By reducing tax liabilities, conserving resources, and supporting growth initiatives, tax management drives economic development and improves the financial well-being of taxpayers and the broader economy.

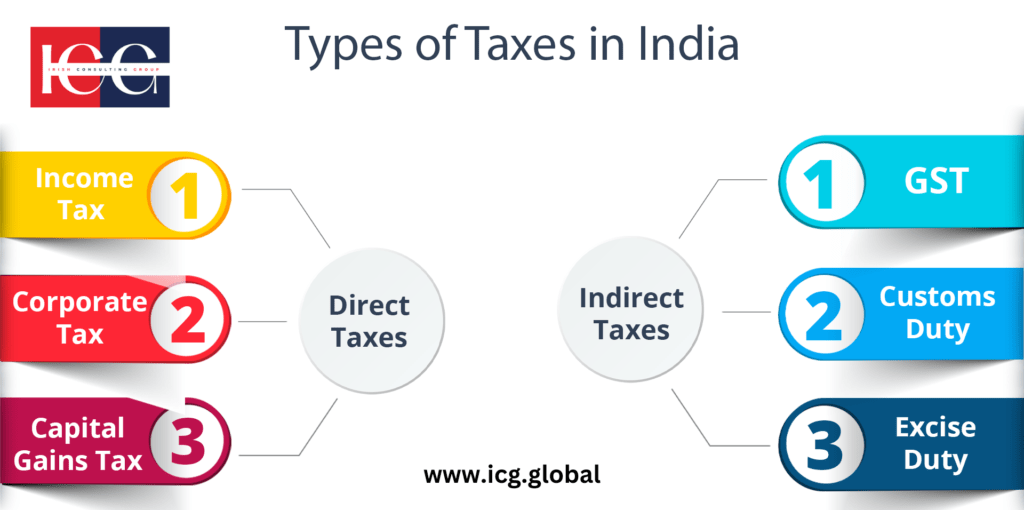

Types of Taxes in India

Direct Taxes

Direct taxes, levied directly on individuals and businesses by the government, are a fundamental part of a country’s taxation system. Major types include income tax, corporate tax, capital gains tax, and wealth tax. Tax services in India are crucial for compliance with these obligations, offering planning, preparation, filing, and advisory services.

Income Tax

Tax Management in India entails efficiently handling income tax obligations through strategic planning and compliance with the Income Tax Act, 1961. Taxpayers, including individuals and entities, must file annual returns declaring income from various sources. Effective management involves using deductions, exemptions, and incentives to minimize tax burdens while complying with legal requirements. Staying informed about tax laws helps taxpayers optimize positions and avoid penalties or audits.

Corporate Tax

Tax services in India ensure compliance with corporate tax regulations, including accurate filing and timely payments. Corporate tax is levied on company profits, with rates varying based on type and turnover. Domestic companies face one rate, while foreign companies are taxed only on income earned within India. Compliance is crucial to avoid penalties.

Capital Gains Tax

Tax management in India entails understanding the complexities of the Income Tax Act of 1961, especially regarding capital assets like stocks or real estate. Differentiating between short-term and long-term gains is essential. Navigating tax rates and exemptions demands careful planning and adherence to regulations. Effective strategies optimize financial outcomes while ensuring compliance.

Indirect Taxes

Indirect taxes are imposed on goods and services and are collected by intermediaries such as retailers or service providers. Tax services in India play a crucial role in ensuring compliance with these indirect tax regulations, navigating complex tax structures, and facilitating the collection and remittance of taxes to the government. Some of the major Indirect Taxes include:

Goods and Services Tax (GST)

GST is a comprehensive indirect tax on goods and services throughout India, replacing multiple taxes like excise duty, service tax, and VAT. It simplifies the tax structure and enhances business operations by being levied at various supply chain stages, allowing input tax credits, and eliminating tax cascading.

Customs Duty

According to the Tax Management in India, customs duty is an indirect tax on imported or exported goods, collected by customs authorities to regulate trade, protect domestic industries, and generate revenue. Rates vary based on factors like goods type, value, and origin, payable by businesses and individuals involved in international trade.

Excise Duty

Excise duty is an indirect tax on goods produced, manufactured, or sold within the country. Paid by manufacturers before goods reach consumers, rates vary depending on product type, with exemptions and concessions available for specific industries and products.

Importance of Tax Planning

Tax Management in India is crucial for efficient resource management and goal attainment. By scrutinizing income, investments, and expenses, individuals and businesses strategically mitigate tax obligations within legal boundaries. This proactive approach ensures optimal allocation of financial resources, paving the way for long-term financial stability and growth.

Methods of Tax Planning

Tax planning involves various strategies to minimize tax liabilities while maximizing savings and investments within the legal framework. By utilizing tax-saving instruments like PPF, NSC, and ELSS, individuals can reduce taxable income. Additionally, leveraging deductions and exemptions outlined in the Income Tax Act further optimizes tax burdens, ensuring efficient resource allocation.

3 Major Challenges in Tax Management in India

Changing Tax Laws and Regulations

Tax management in India is crucial for individuals and businesses. The ever-changing tax laws pose challenges to understanding and compliance. Staying updated is vital for effective tax management, ensuring compliance and minimizing tax liabilities.

Compliance Burden on Taxpayers

The burden of tax compliance weighs heavily on taxpayers, especially small businesses and individuals. Meeting various filing requirements, deadlines, and documentation obligations can be time-consuming and resource-intensive.

Complexities in Tax Calculations

Tax management in India is challenging, especially for businesses with international operations. Complex calculations require skilled handling to ensure compliance and optimization. Expert advice and advanced software help mitigate these challenges. Leveraging specialized expertise and technology is crucial for effectively managing tax obligations and enhancing financial efficiency in India’s complex tax environment.

Government Initiatives for Tax Management in India

Simplification of Tax Laws

The government has been undertaking initiatives to simplify tax laws and procedures, making it easier for taxpayers to understand and comply with them.

Digitalization of Tax Processes

The digitalization of tax processes, such as online filing of returns and electronic verification, has streamlined tax administration and enhanced efficiency. Tax management in India has significantly benefited from these advancements, allowing for smoother and more effective handling of tax-related tasks.

Incentives for Tax Compliance

The government provides incentives and rewards for timely tax compliance, encouraging taxpayers to fulfill their obligations voluntarily.

Future Trends in Tax Management in India

Technological Advancements in Tax Management

The future of tax management is likely to witness technological advancements such as artificial intelligence, blockchain, and data analytics, enabling more efficient and transparent tax processes.

Predictions for the Future of Tax Planning

Predictions on how tax planning strategies may evolve in response to changing economic, regulatory, and technological landscapes.

Tax Services in India: The Vitality of Seeking Professional Advisory

In the complex landscape of tax management in India, tax advisory plays a pivotal role in ensuring compliance, maximizing benefits, and mitigating risks for individuals and businesses alike. Seeking professional tax services in India is not just advisable but often indispensable. Here’s why:

- Navigating Complexity: Tax management in India requires navigating through a labyrinth of laws, regulations, and amendments. Professional tax advisors possess the expertise to interpret these complexities accurately, helping clients understand their tax obligations and rights.

- Compliance Assurance: Tax Management in India services are subject to frequent changes, making compliance a challenging task. Professional advisors stay abreast of these changes, ensuring that their clients comply with all legal requirements, thereby avoiding penalties and legal entanglements. These professionals play a crucial role in navigating the complexities of the ever-evolving tax landscape in India.

- Optimization of Tax Liabilities: Through strategic planning and careful analysis, tax services in India can help individuals and businesses optimize their tax liabilities. By identifying applicable deductions, exemptions, and credits, they ensure that clients pay the minimum required taxes while staying within the bounds of the law.

- Risk Mitigation: Tax audits and investigations are common in India, and non-compliance can lead to severe consequences. Professional tax advisors conduct thorough reviews of their clients’ financial affairs, identifying and rectifying potential red flags to minimize the risk of audits and penalties.

- Efficient Tax Planning: Effective tax planning is essential for individuals and businesses to achieve their financial goals. Tax advisors devise personalized strategies tailored to their clients’ specific circumstances, whether it’s estate planning, retirement planning, or business expansion, helping them make informed decisions that optimize their tax outcomes. Tax services in India play a crucial role in navigating the complex tax landscape and maximizing benefits.

- Expert Representation: In the event of tax disputes or litigation, having expert representation can make a significant difference in the outcome. Professional tax advisors possess the expertise to represent their clients before tax authorities, tribunals, and courts, advocating on their behalf and safeguarding their interests effectively.

- Cost-Effectiveness: While some individuals and businesses may perceive professional tax services in India as an additional expense, in reality, they often prove to be cost-effective in the long run. By minimizing tax liabilities, maximizing benefits, and averting penalties, tax advisors help clients save more money than they spend on their services.

- Peace of Mind: Tax-related matters can be stressful and time-consuming, particularly for those unfamiliar with the intricacies of the Indian tax system. Engaging professional tax advisors alleviates this burden, providing clients with peace of mind knowing that their tax affairs are in capable hands.

In summary, the importance of professional tax services in India cannot be overstated. From navigating complex tax laws to optimizing liabilities and managing risks, tax advisors ensure financial well-being and compliance. Investing in these services is essential for long-term financial success and peace of mind.

Summary

Tax management in India involves strategic planning to minimize tax liabilities and ensure compliance with legal obligations. This includes understanding various tax types like direct and indirect taxes and using strategies such as investments in tax-saving instruments, deductions, and compliance with tax laws. Despite challenges like evolving tax laws and combating tax evasion, professional tax advisory services offer expertise and tailored solutions. Effective tax management is crucial for individuals and businesses to optimize finances, reduce tax burdens, and adhere to legal requirements in India.