What are Investment Advisory Services?

Investment advisory services refer to professional guidance provided to individuals, businesses, or institutions seeking assistance with managing their investment portfolios. These services are typically offered by financial professionals such as investment advisors, financial planners, or wealth managers.

The main goal of investment advisory services is to help clients achieve their financial objectives by creating investment strategies. Indian advisory services strategies align with their risk tolerance, investment goals, and time horizon. Advisors analyze clients’ finances, assess their investment needs, and recommend appropriate investments like stocks, bonds, mutual funds, or alternative investments.

Additionally, investment advisors continually monitor and manage client portfolios, making necessary adjustments to align with market changes and client circumstances. They offer guidance on retirement, tax, estate planning, and financial help to build long-term wealth.

Overall, investment advisory services play a crucial role in helping individuals and organizations make decisions about their investments and achieve goals.

Unlock Financial Success: What an Investment Advisor Can Do for You

An investment advisor is a financial professional who provides personalized advice and guidance to individuals, businesses, or institutions regarding their investment portfolios. These professionals typically have expertise in various financial products and markets and help clients make informed decisions to achieve their financial goals.

Investment Advisory Services encompass a comprehensive assessment of clients’ financial circumstances, including their risk tolerance, investment objectives, and time horizon. Leveraging this information, advisors create investment strategies and suggest investments such as stocks, bonds, mutual funds, ETFs, or alternative investments. This personalized approach aims to optimize clients’ portfolios based on their financial goals while considering their unique preferences and constraints.

In addition to offering investment advice, investment advisors often provide ongoing portfolio monitoring and management services. They track market trends, evaluate investment performance, and make adjustments to clients’ portfolios to optimize returns and manage risk effectively.

Investment advisory services extend beyond managing investment portfolios. They also provide guidance on broader financial planning matters, including retirement planning, tax optimization, estate planning, and wealth preservation strategies. By offering comprehensive advice in these areas, advisors help clients achieve long-term financial security and meet their financial goals effectively.

Overall, an investment advisor serves as a trusted partner for clients. They help investors navigate the complexities of the financial markets and make informed decisions to build wealth over time.

Investment Tax: An overview

Investment tax refers to the taxation of income and gains generated from various types of investments. It encompasses the taxes levied on returns earned from investments such as stocks, bonds, mutual funds, real estate, and other financial instruments.

Here’s an overview of key aspects:

Types of Investment Income:

Investment income can be categorized into different types for tax purposes:

Ordinary Income:

This includes interest income from bonds, savings accounts, and CDs, as well as dividends from stocks that are not qualified.

Capital Gains:

Capital gains result from the sale of stocks, mutual funds, or real estate at a price higher than purchase price.

Qualified Dividends:

These are dividends received from certain domestic and foreign corporations that meet specific criteria set by the IRS. Qualified dividends are taxed at lower capital gains rates.

Passive Income:

Income generated from passive investments, such as rental income from real estate or income from limited partnerships.

Taxation of Investment Income:

Ordinary Income Tax:

Interest income and non-qualified dividends are typically taxed at ordinary income tax rates, which can range from 10% to 37%.

Capital Gains Tax:

Capital gains are subject to capital gains tax, which is typically lower than ordinary income tax rates. Short-term capital gains (gains from assets held for one year or less) are taxed at ordinary income tax rates. While long-term capital gains (gains from assets held for more than one year) are taxed at preferential rates ranging from 0% to 20%,

Net Investment Income Tax (NIIT):

This is an additional 3.8% tax on certain investments. Income for individuals with higher incomes (over $200,000 for single filers and $250,000 for married couples filing jointly).

Tax-Advantaged Accounts:

Certain investment accounts offer tax advantages that can help minimize tax liabilities, such as:

401(k) and Traditional IRA:

Contributions to these retirement accounts are typically tax-deductible, and investment earnings grow tax-deferred until withdrawals are made in retirement.

Roth IRA:

While contributions to a Roth IRA are not tax-deductible, qualified withdrawals, including earnings, are tax-free.

Health Savings Account (HSA):

Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

Tax Reporting and Compliance:

Investors are required to report their investment income and gains on their tax returns accurately. This may involve filing forms, such as Schedule B, for interest and dividends. Schedule D is for capital gains and losses, and Form 8960 is for net investment income tax.

Understanding the tax implications of various investments is crucial for investors to make decisions and effectively manage tax liabilities while maximizing returns. Consulting with a tax professional or financial advisor can provide valuable guidance tailored to individual financial circumstances.

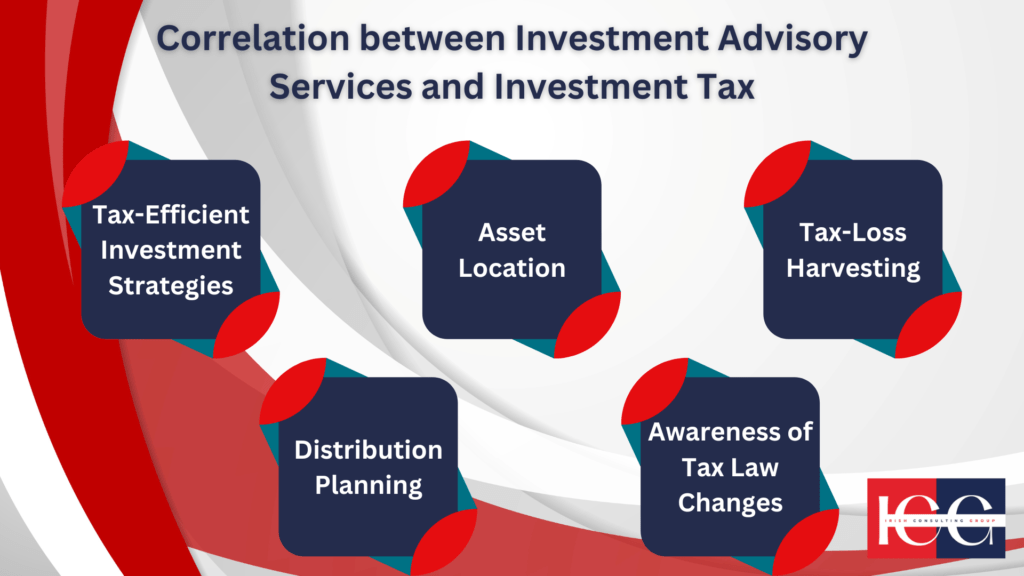

Correlation between Investment Advisory Services and Investment Tax

Investment advisors help clients navigate tax implications while managing portfolios. This shows the connection between advisory services and investment taxes. Here’s how these two aspects are interconnected:

Investment Advisory Services: Tax-Efficient Investment Strategies

Investment advisors consider the tax consequences of investment decisions when creating strategies for their clients. They aim to maximize after-tax returns by strategically allocating assets across different types of accounts and selecting tax-efficient investment vehicles.

Investment Advisory Services: Asset Location

Investment advisors may recommend specific asset allocation strategies that take into account the tax treatment of different types of investments. For example, they advise placing tax-inefficient investments, such as bonds generating interest income, in tax-advantaged accounts to minimize tax liabilities. Conversely, growth stocks with lower dividends may be held in taxable accounts to benefit from favorable capital gains tax rates.

Investment Advisory Services: Tax-Loss Harvesting

Investment advisors employ tax-loss harvesting strategies to offset capital gains with capital losses, thereby reducing clients’ tax bills. They may periodically review portfolios to identify investments with unrealized losses for tax benefits

Investment Advisory Services: Distribution Planning

Investment advisory services encompass assisting clients with tax-efficient distribution strategies, particularly during retirement or when liquidating investments. These services involve optimizing the timing and structure of withdrawals to minimize tax implications. Investment advisors work closely with clients, coordinating distributions from various accounts to manage tax brackets effectively and mitigate the impact of Required Minimum Distributions (RMDs) from retirement accounts. By leveraging their expertise in investment and tax matters, investment advisory services aim to maximize after-tax returns and help clients achieve their financial objectives while navigating complex tax regulations.

Awareness of Tax Law Changes:

Investment advisors stay abreast of changes in tax laws and regulations, keeping clients informed about potential tax implications for their investment strategies. They proactively adjust investment plans to adapt to changes in tax policies, ensuring clients remain compliant and take advantage of available tax-saving opportunities.

Overall, investment advisory services encompass not only investment management but also tax planning and optimization. By integrating tax considerations into investment decisions and strategies, advisors help clients minimize tax liabilities and enhance after-tax returns, ultimately contributing to the achievement of clients’ financial goals.

Where to find Investment Advisory Services?

You can find investment advisory services offered by ICG (Irish Consulting Group) by visiting our website or contacting us directly.

ICG offers a comprehensive suite of services including legal, financial, strategic management, HR, payroll, and international business consulting. ICG has a dedicated investment advisory division specializing in tailored investment strategies.

Here are some steps to find investment advisory services from ICG:

Visit our Website: https://icg.global/ explore the services we offer. Look for sections or tabs related to financial services or investment advisory.

Contact ICG: Reach out to us through our contact information provided on our website: https://icg.global/contact-us/.

This includes email addresses, phone numbers, or an online contact form. Inquire specifically about our investment advisory services and express your interest in learning more or scheduling a consultation.

Consultation: Schedule a consultation with ICG’s representatives to discuss your investment needs, goals, and preferences. Discover our investment advisory approach, expertise, and portfolio management solutions.

Discover our investment advisory services and how we can help you reach financial goals.

Want to stay updated on our latest initiatives? Follow us on LinkedIn for industry insights and company news: https://www.linkedin.com/company/irish-consulting-group/.

Summary

Investment advisors offer professional guidance and personalized advice to individuals, businesses, and institutions seeking help with managing investment portfolios. Subsequently, financial professionals analyze clients’ finances, assessing their investment goals and risk tolerance to recommend suitable investment strategies and products. Furthermore, advisors actively monitor and manage portfolios, providing invaluable tax and retirement planning guidance. Ultimately, these services help clients achieve financial objectives while maximizing returns and minimizing risks.